This post is sponsored by Zelle® and the InfluenceHer Collective. All opinions are my own. Thank you for supporting the brands that make Miss Moore Style possible!

What is the one thing your mom always told you to steer away from in polite conversation? Politics, religion, and money, right? Well, I’m here to talk about the last one, because like my girl Cardi B, I like

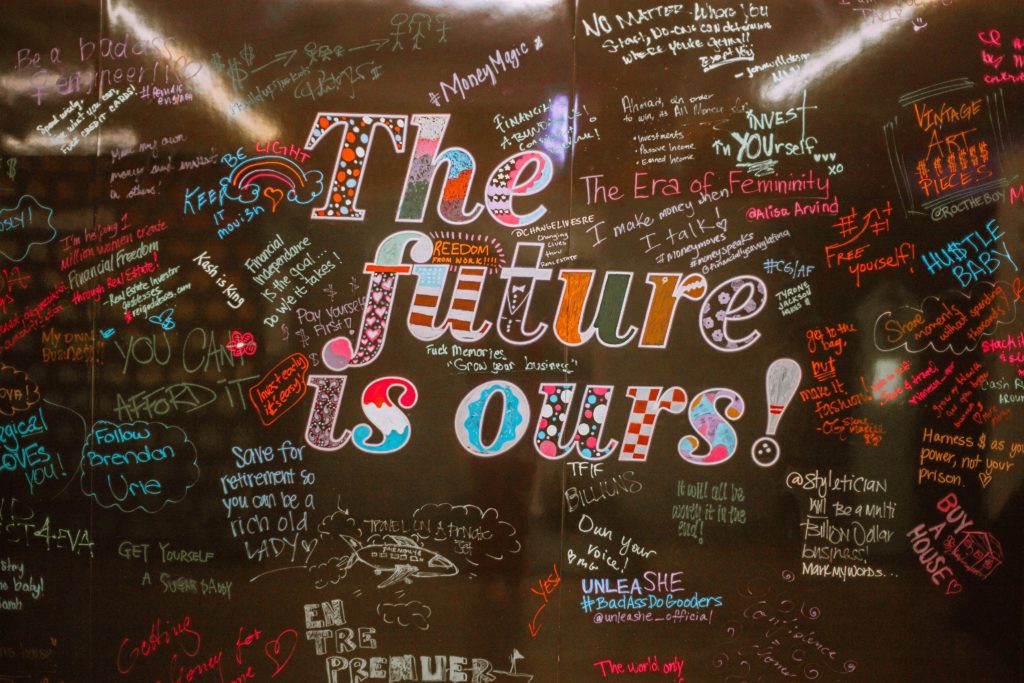

boardin’ jets, and the only way to do that is with money! 80% of women avoid talking about money with family and friends. It’s time to change that. From asking to be paid back for the take-out you ordered for your roommates, to collecting money to fix that leaky faucet, the little things can add up. You can take charge of your finances and make those money moves. As a recent-ish college grad and a gal who loves to find ways to save money, I wanted to share some tips on how to manage your money post graduation so you can set yourself on a path to a successful future!

Manage your Money Post Graduation: Dealing with Debt

Debt is a bit of a dirty word, isn’t it? It is definitely something that gives me a little knot in my stomach even to think about. Women’s combined student debt is approximately $900 BILLION, which is roughly 2/3 of the total outstanding debt in the United States. Cool, cool, I mean, you can’t NOT get an education, right? The key is to be smart about your student loans BEFORE you graduate. Find out what your monthly payments are going to look like when you have to start paying those loans off so you are prepared for life post-grad so you know exactly how much money you need to make each month, and do not get behind in those payments!

Of course, student loan debt isn’t the only kind of debt you need to get smart about. Credit card debt is another way you can manage your money post graduation in a way that is smart, if you play your cards right…see what I did there? I used to be afraid of credit cards until I learned to make them work for me. They key is to choose cards that reward you for purchases you regularly make, and to only use those credit cards for purchases you would be comfortable making with your debit card. Have I been tempted to buy that Chanel Boy Bag I want so badly on my credit card- yes! Do I do it- hell no! I also make sure that I pay my statement balance each month and only carry 30% of my total credit limit so I can keep my credit score high. Having a good credit score is crucial for your future if you plan to rent an apartment, buy a car, or buy a home someday.

Manage your Money Post Graduation: Peer Pressure to Spend

Post-graduation life is exciting: you finally have a “real” job, you’re making more money, and you are out on your own navigating adulthood in your early-mid twenties. Obviously, a huge part of this is having fun with your friends on the weekends and after work, and that fun usually involves happy hours, dinners, or brunches, possibly even travel. While this is all fun and I fully support participating in all of it, you need to make sure that you are not over-spending in these areas, especially if you’re trying to be financially responsible or you’re saving up for a goal. Everyone is in a different financial position, and you may have those friends who you always know will want to get brunch every weekend or who always want to grab dinner at that spot that is a tag more pricey than you like. Here are some tips on how to manage your money post graduation in your social life:

- Have a “money buddy’: This is a friend who you can ask to help keep you accountable with your finances and someone you can trust to discuss what you’re comfortable spending on a night out.

- Get creative: You don’t always have to go out to have a good time. Invite your girls over for a night in of self care and face masks, or have the crew over for game night. These are affordable and easy ways to have fun with your friends without spending all your hard earned money!

- Cut the evening up: If that one very extravagant friend is celebrating their birthday with a big dinner out followed by bar hopping, maybe just join for desert, or tell them you’ll meet them at the bar later. This way, you can still participate in the evening without feeling compelled to spend money all night long.

- Have a system in place when you’re going on a girl’s trip. Zelle is a fast, safe and easy way to send money to friends, family and others you trust, right from your banking app, so you can easily split the costs of group travel without all the headache! Visit zellepay.com for more info!

Manage your Money Post Graduation: Invest in Your Future

Investing is admittedly the area that I am not the strongest at, but I am always looking to educate myself and change that! One easy step to take to manage your money post graduation is to ask your new employer about the benefits that are at your disposal. If they offer a 401k, get in on that ASAP! If you happen to be in a more untraditional career path, like myself, look into a Roth IRA. The bottom line is to make sure that you are looking out for your future each month by first paying your bills and setting aside some money for retirement before you go out and spend. Don’t put these things off for later, set them up as soon as you can!

Here’s the thing: even the most vocal, badass women sometimes feel uncomfortable talking about money – but when women empower each other through discussion, knowledge, and ongoing education, we all become more successful. So whether it’s asking friends to send money for that dinner you put on your card, or letting your sweet grandmother know you’d rather have $78 than a $78 antique porcelain cat figurine, there are opportunities in your everyday life to be straightforward about money. And when you make bold money moves, something magical happens. You get what you really want. And you have the freedom to live your best life, on your own terms. Presented by Zelle”

I hope you enjoyed this edition of Real Talk from Miss Moore Style! What female empowerment topics would you like me to cover next time? Please leave a comment down below and leave me your suggestions!

This is so important!

briana

https://beyoutifulbrunette.com/